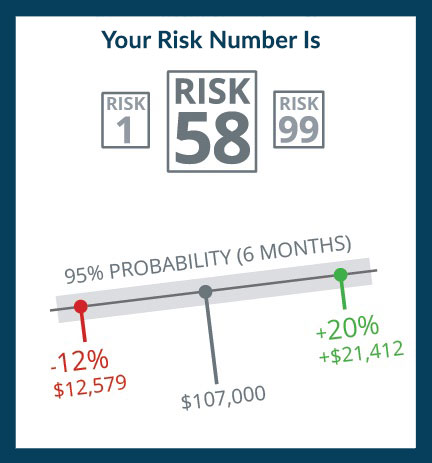

1. Understand Investment Risk

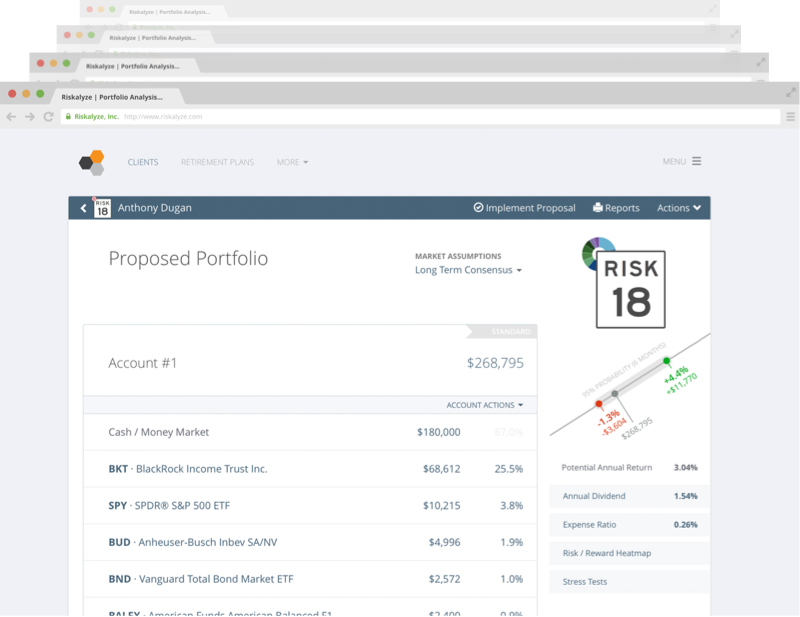

2. Review & Align Current Investments

4 out of 5 people have more risk in their portfolios than they previously realized. We make sure your portfolio risk number matches your personal risk number. The resulting proposed portfolio will include projections for the potential gains and losses we should expect over time.

3. Test Your Investments

Stress tests illustrate how your proposed portfolio would have fared through various market events over the past 8 years, including the financial crisis and recovery.

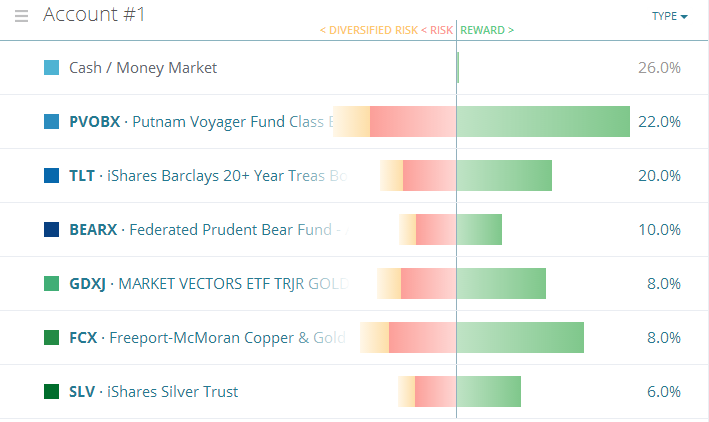

4. Risk vs Reward

We can visualize the risk and reward profile for each individual investment we propose for your portfolio. Illustrating risk, reward and diversified risk gives us a powerful tool to review before we make any final investment decisions.

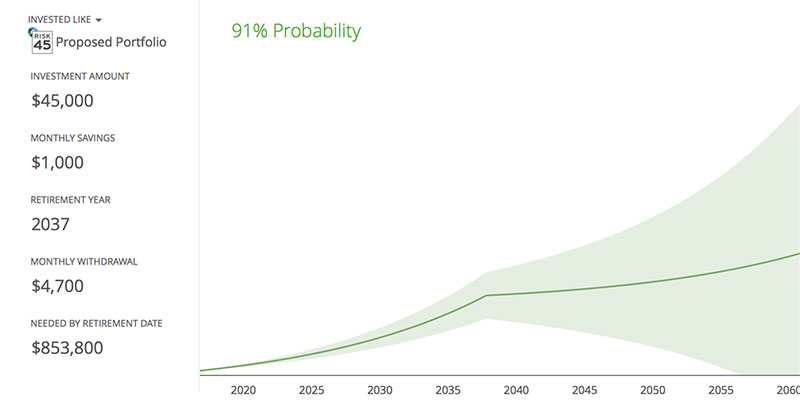

5. Peace of Mind

Before we’re finished, we’ll also review your progress toward your financial goals by building a Retirement Map. When you’re done, you’ll fully understand the probabilities of success, and what we can to do to increase it.